Based on our management policy, we have formulated our new Second Mid-Term Management Plan. The goal of our group is to become a value co-creation company, and we aim to build a strong management base and create new value through further growth of existing businesses and the establishment of new businesses.

Chairman and President

Group CEO

Shuji Inaba

Table of Contents

1. Koh-EN TV

Positioning of the Medium-Term Management Plan and Management Objectives

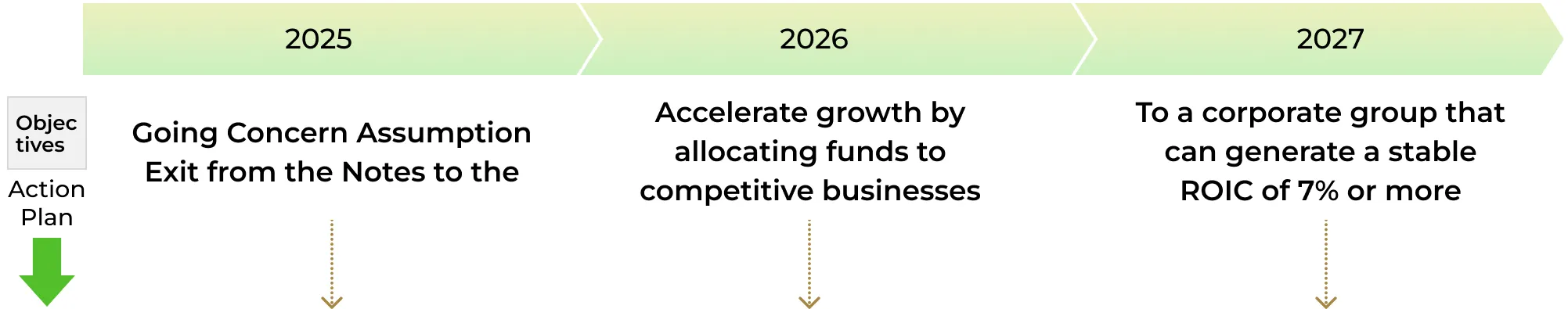

The ” New Oak Capital_First Medium-Term Management Plan ” announced on June 17, 2022 is as follows.

| (Unit: Billions of yen) | Record high results | Management target to exceed record results |

|---|---|---|

| Consolidated Net Sales | 243 (FY2007/3) | 250 (FY2007/3) |

| Consolidated Net Income | 18 (FY2015/3) | 20 |

| Market capitalization | 573 (FY2005/3) | 600 (FY ended March 31, 2005) |

| First Medium-Term Management Plan | 2nd Mid-Term Management Plan | ||

|---|---|---|---|

| Positioning | 25, 2, 60″ to

Reform/transformation period |

25, 2, 60″ Establishing a firm footing | Achievement of “25, 2, 60” |

| Management Objectives | Business restructuring

Extraordinary loss recorded |

Return to profitability on a consolidated and non-consolidated basis and resume dividend payments | Secure stable earnings and continue business growth |

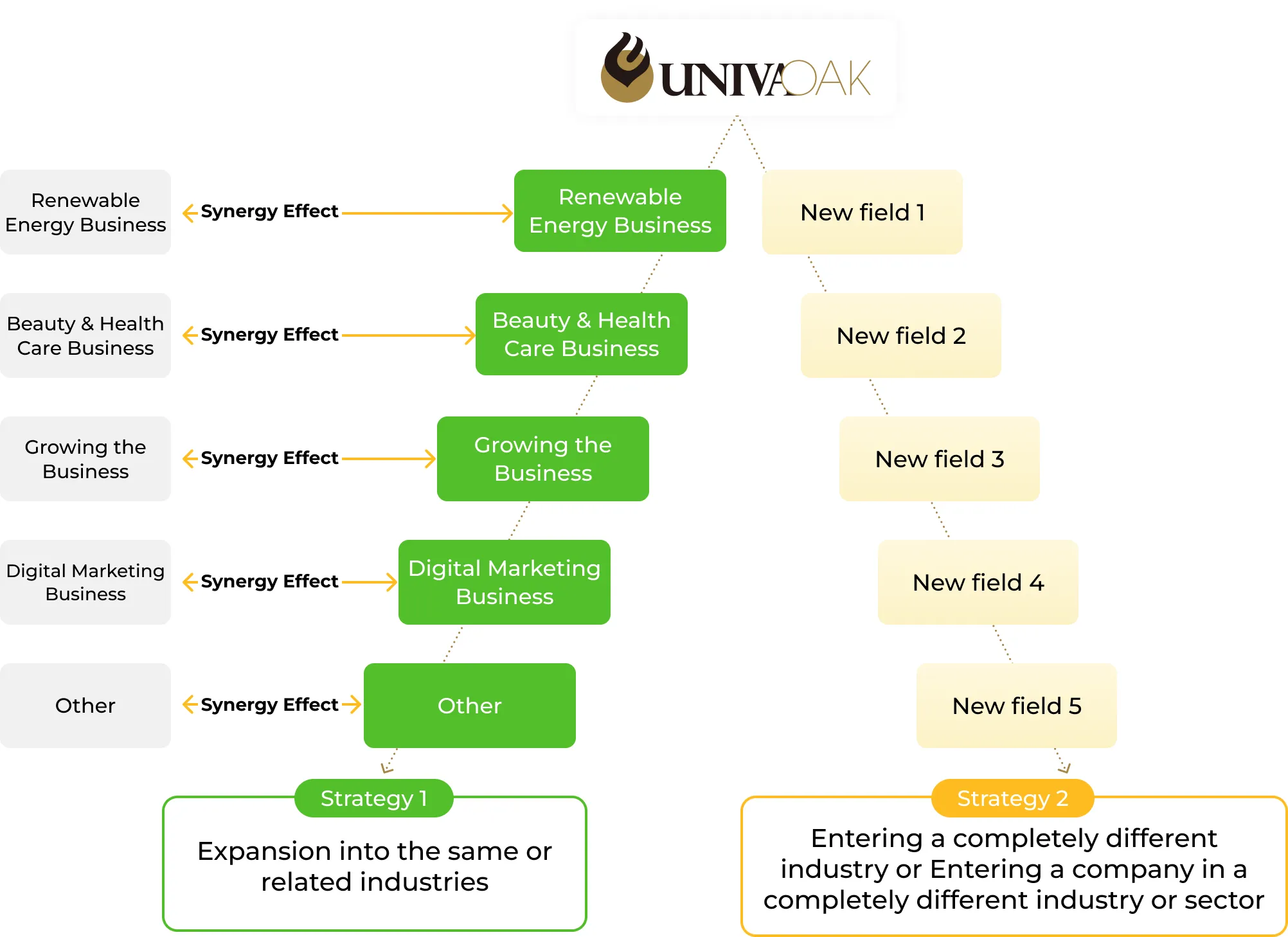

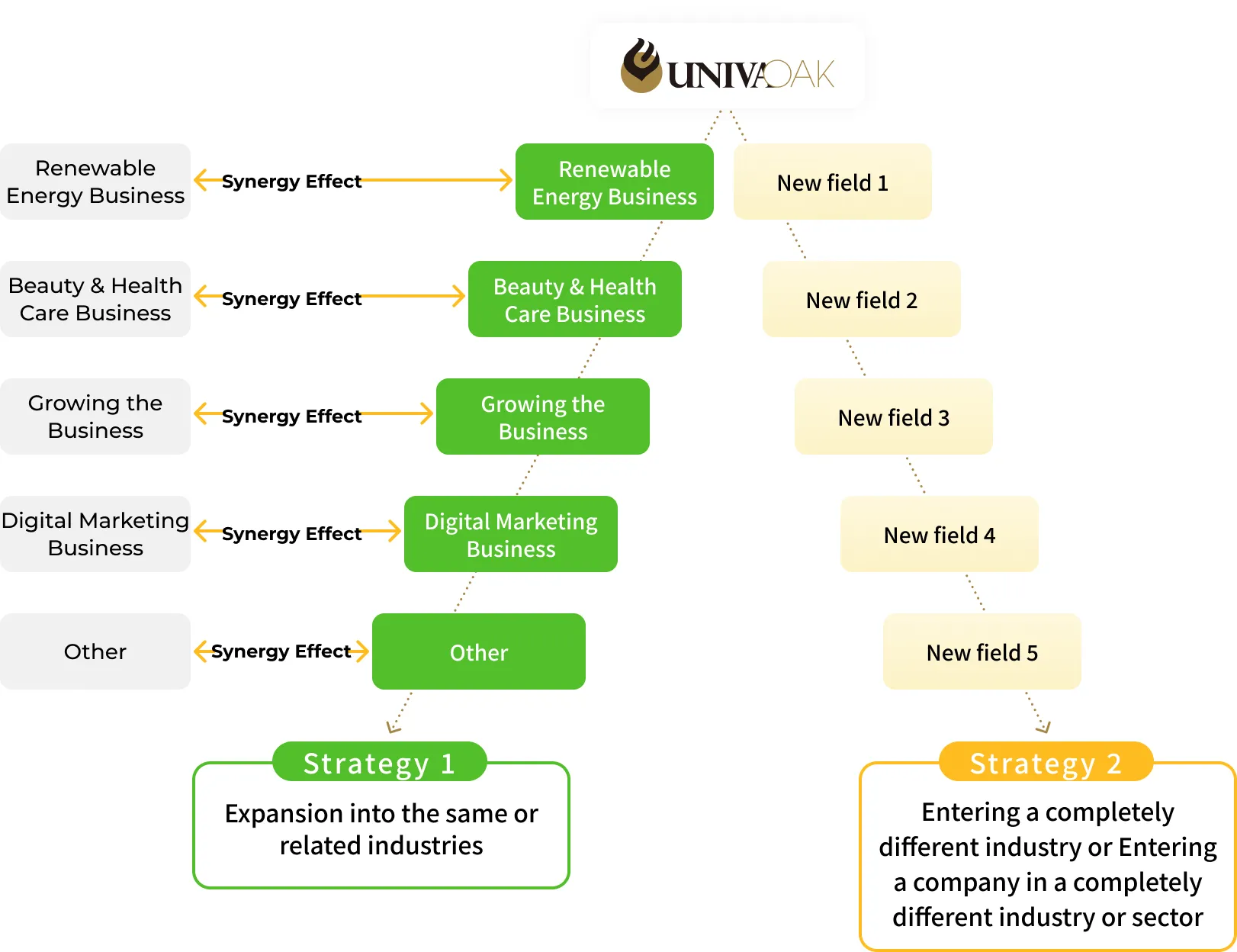

3. growth strategy

In order to achieve the goal of “25.2.60,” we will break through the current situation with the strategy of “expanding our business horizontally (expansion) and vertically (deepening).

Group Growth Strategy (1)

- Growth Support

- Beauty &

Health Care - Renewable

Energy - Digital

Marketing - Media

- Brand

- Resort

- Restaurant Revitalization

- Shared

Services

Dig deeper vertically into the current business to

become a company that can generate solid profits.

- +C

Business - +B

Business - +A

Business

Expand business horizontally and increase the number of new

“NAKAMA”.

Group Growth Strategy (2)

We will open up new possibilities through horizontal business development and welcome new “NAKAMA” to create value together.

Strategies for each group company

Renewable Energy Business

Develop and expand the Group’s renewable energy business nationwide to contribute to the realization of a decarbonized society.

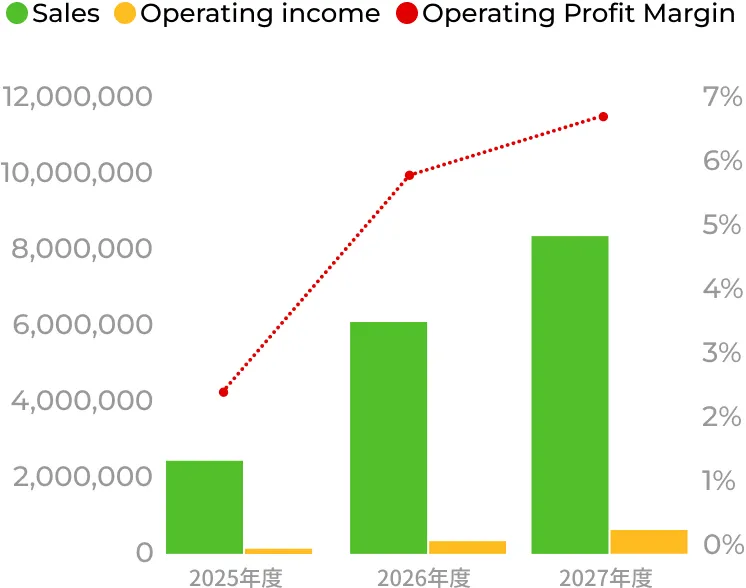

Three-Year Plan

| Fiscal year 2025 | Fiscal year 2026 | Fiscal year 2027 | |

|---|---|---|---|

| Net Sales | 2,530,000 | 5,966,000 | 8,530,000 |

| Operating income | 57,500 | 338,000 | 559,000 |

| Operating profit ratio | 2% | 6% | 7% |

Initiatives for Realization

| summary | |

|---|---|

| #1 |

Power Supply Development (Low-voltage) has been conducting sales activities mainly in Hokkaido, but will expand its service deployment area in the future. |

| #2 |

Currently, the company’s main focus is on the development of low-voltage power sources, but in the future it will expand its business domain to include high-voltage and grid storage batteries. |

| #3 |

Currently, sales activities are focused on new electric power companies and off-site PPA providers, but the scope of sales activities will be expanded to include corporations, local governments, and public agencies. |

| #4 |

The company will review its current contractual arrangements and secure revenue by divesting insurance and revising rates, while building a new O&M business to expand its operations. |

Beauty & Health Care Business

The company aims to be a “revolutionary child” that will pioneer the future of the health and beauty industry by bringing about innovations that are not bound by existing frameworks.

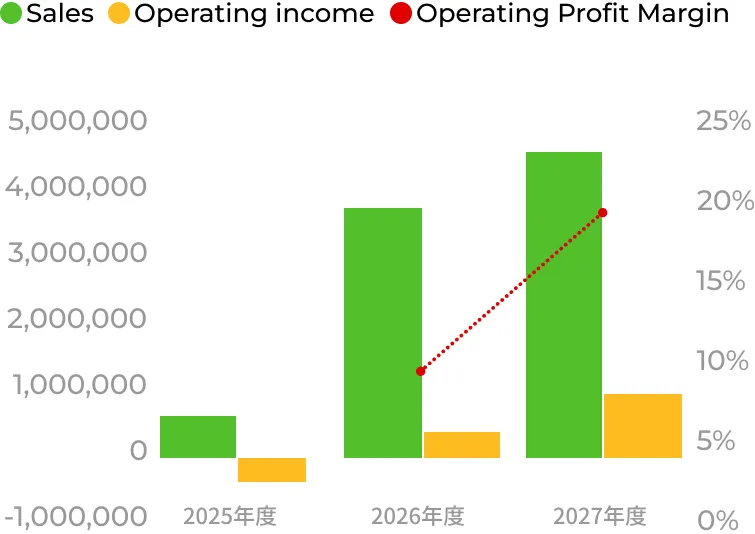

Three-Year Plan

| Fiscal year 2025 | Fiscal year 2026 | Fiscal year 2027 | |

|---|---|---|---|

| Net Sales | 596,000 | 3,459,000 | 4,534,000 |

| Operating income | -359,200 | 325,800 | 888,800 |

| Operating income ratio | 9% | 20% |

Initiatives for Realization

| summary | |

|---|---|

| #1 |

Create a highly concentrated serum as a second hit product. |

| #2 |

Incorporate the store name into the product name. |

| #3 |

Develop a low-priced sub-line for B2B. |

| #4 |

Cross-selling of “health care products” & “beauty products |

| #5 |

Cross-border EC Challenges |

Growth Support Business

Establish a business model for UNIVA Securities to provide strategic financing and corporate value enhancement solutions.

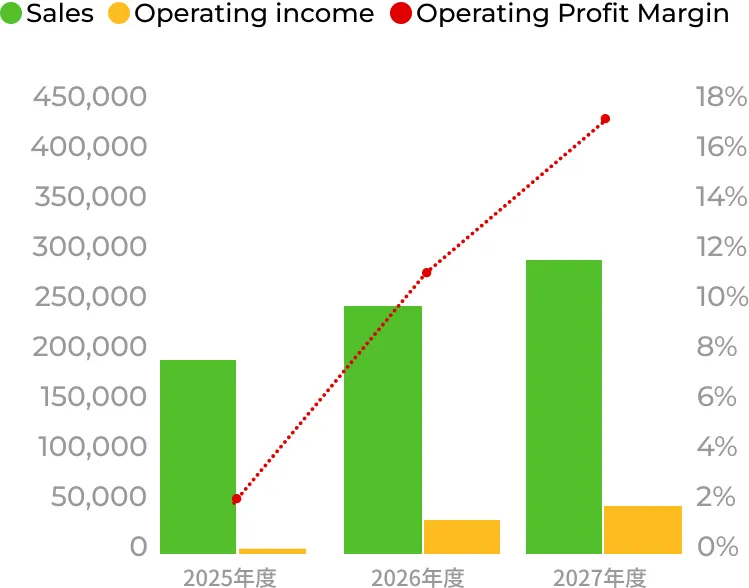

Three-Year Plan

| Fiscal year 2025 | Fiscal year 2026 | Fiscal year 2027 | |

|---|---|---|---|

| Net sales | 187,000 | 246,000 | 293,000 |

| Operating income | 4,620 | 26,120 | 49,720 |

| Operating profit ratio | 2% | 11% | 17% |

Initiatives for Realization

| summary | |

|---|---|

| #1 |

The co-creation business model will work with UNIVA Securities, a financial instruments firm, and its client network, including M&A firms and IFAs, to establish a proper transaction mechanism. |

| #2 |

To establish a system that provides investors with stable income and capital gains and companies with growth capital and management support, thereby benefiting both investors and companies. |

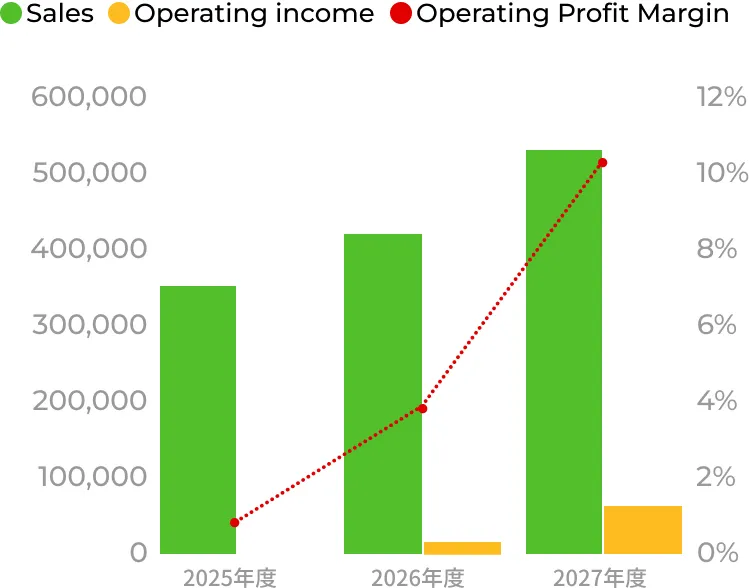

Digital Marketing Business

Achieved No. 1 in the industry in word-of-mouth acquisition support services and went public.

Three-Year Plan

| Fiscal year 2025 | Fiscal year 2026 | Fiscal year 2027 | |

|---|---|---|---|

| Net sales | 355,000 | 426,000 | 519,000 |

| Operating income | 1,890 | 15,200 | 52,000 |

| Operating profit ratio | 1% | 4% | 10% |

Initiatives for Realization

| summary | |

|---|---|

| #1 |

Planned for FY2026 to improve creditworthiness, name recognition, talent acquisition, and business networking of underperforming companies. |

| #2 |

We will leverage our accumulated functions and know-how to take on the challenge of entering a larger market and providing high-quality services. |

| #3 |

The excursion information media “Itoko” will start in Karuizawa, Nagano, and expand nationwide, including to major cities, with the aim of generating revenue. |

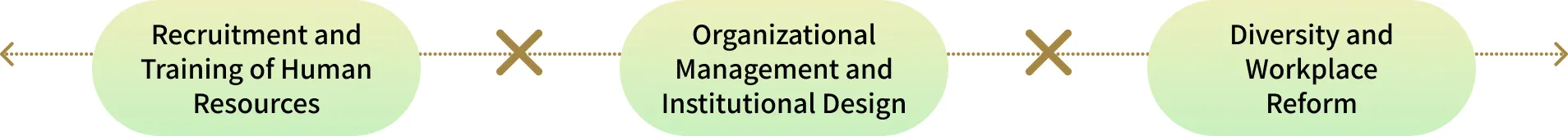

5. Human Capital Strategy

We emphasize the value of employees as “capital” (human resources) and aim to benefit both employees and the company through maximizing their potential.

Improve the expertise of each employee and foster professionalism,

fairly evaluate the growth process, support challenges, and promote diversity management.

- Promote recruitment of human resources with the dual focus of “securing immediate workforce” and “securing next-generation human resources”.

- Formulate and promote cross-group human resource development/training programs

- Support for employee career independence

- Fair and appropriate personnel treatment through a job-based personnel system

- Establishment and operation of a compensation system that emphasizes performance/performance incentives

- Establishment and operation of effective benefit programs

- Building solid engagement through one on one meetings

- Further promotion of diverse work styles Flexible work arrangements and infrastructure to support these arrangements

- Diversification of the decision-making body for promoting women’s advancement and absorbing innovative proposals

- Promote health management to enhance employee well-being

6. Capital Strategy

| B/S |

|

|

|

|---|---|---|---|

| P/L |

|

|

|

| Other |

|

||

With the establishment of UNIVA Oak Holdings’ new Second Medium-Term Management Plan, the entire group is now united and ready to move forward to the next stage of growth. Taking this opportunity, we will move steadily forward on our path as a “value co-creation company” that goes beyond mere business growth to create new value together with society, customers, and partners.